Mrs ramos is considering a medicare advantage ppo – Mrs. Ramos is considering a Medicare Advantage PPO, a popular option among seniors seeking comprehensive and flexible health coverage. This article will delve into the key features, benefits, and considerations associated with Medicare Advantage PPOs, empowering Mrs. Ramos and other seniors to make informed decisions about their healthcare.

Medicare Advantage PPOs offer a blend of coverage and flexibility, providing a comprehensive overview of the topic.

Understanding Medicare Advantage PPOs

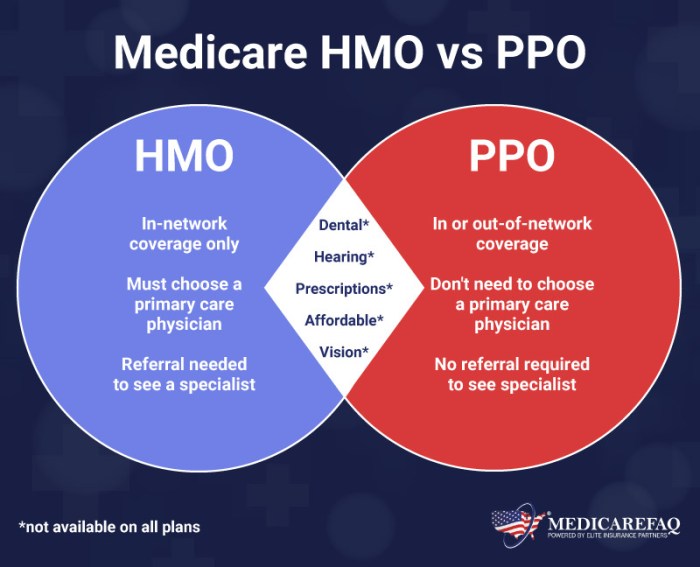

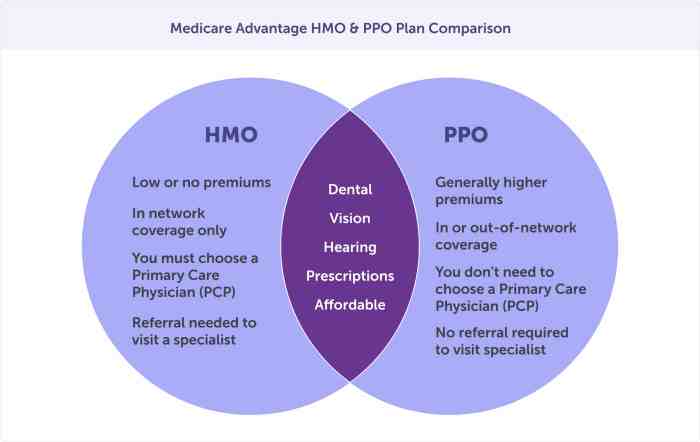

Medicare Advantage PPOs (Preferred Provider Organizations) are a type of Medicare health plan that provides coverage for medical services through a network of preferred providers. They offer a combination of flexibility and cost-effectiveness, making them a popular option for many Medicare beneficiaries.

Key features and benefits of Medicare Advantage PPOs include:

- Network of preferred providers: PPOs contract with a network of healthcare providers, including doctors, hospitals, and other healthcare facilities.

- Lower costs: PPOs typically have lower premiums and out-of-pocket costs than Original Medicare.

- Flexibility: PPOs allow beneficiaries to choose from a wider range of providers within their network, including out-of-network providers at a higher cost.

- Coverage: PPOs cover a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and preventive care.

Eligibility and Enrollment

To be eligible for a Medicare Advantage PPO, you must be enrolled in Original Medicare (Part A and Part B) and meet the following criteria:

- You are 65 years of age or older.

- You are under 65 with a qualifying disability.

- You have End-Stage Renal Disease (ESRD).

The enrollment process for Medicare Advantage PPOs is as follows:

- During the Medicare Open Enrollment Period (October 15 – December 7), you can enroll in a Medicare Advantage PPO by contacting the plan directly or through the Medicare website.

- You can also enroll in a Medicare Advantage PPO during the Medicare Advantage Open Enrollment Period (January 1 – March 31).

- If you are eligible for both Medicare and Medicaid, you may be able to enroll in a Medicare-Medicaid Plan (MMP) at any time of the year.

Coverage and Costs

Medicare Advantage PPOs offer a comprehensive range of coverage, including:

- Doctor visits

- Hospital stays

- Prescription drugs

- Preventive care

- Other medical services as defined by the plan

The costs associated with Medicare Advantage PPOs vary depending on the plan you choose and your location. Premiums, deductibles, and copays are common costs associated with Medicare Advantage PPOs.

Network of Providers

The network of providers is a key feature of Medicare Advantage PPOs. PPOs contract with a network of healthcare providers, including doctors, hospitals, and other healthcare facilities. These providers agree to provide services to plan members at a discounted rate.

When choosing a Medicare Advantage PPO, it is important to consider the plan’s network of providers. You should make sure that your preferred providers are included in the network. You can find a list of providers in a plan’s network on the plan’s website or by contacting the plan directly.

Advantages and Disadvantages

There are several advantages to choosing a Medicare Advantage PPO, including:

- Lower costs: PPOs typically have lower premiums and out-of-pocket costs than Original Medicare.

- Flexibility: PPOs allow beneficiaries to choose from a wider range of providers within their network, including out-of-network providers at a higher cost.

- Coverage: PPOs cover a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and preventive care.

There are also some potential disadvantages to choosing a Medicare Advantage PPO, including:

- Limited network: PPOs have a limited network of providers. This means that you may not be able to see your preferred providers.

- Higher costs for out-of-network care: If you see a provider who is not in your PPO’s network, you may have to pay higher costs.

- Limited coverage: PPOs may not cover all of the medical services that you need.

Comparison with Other Medicare Options

Medicare Advantage PPOs are one of several Medicare options available to beneficiaries. Other options include Original Medicare, Medicare Supplement plans, and Medicare Savings Accounts (MSAs).

Original Medicare is the traditional Medicare program. It is a fee-for-service program, which means that you pay for each medical service you receive. Original Medicare does not have a network of providers, so you can see any doctor or hospital that accepts Medicare.

Medicare Supplement plans are private insurance plans that help to cover the costs of Original Medicare. Medicare Supplement plans do not have a network of providers, so you can see any doctor or hospital that accepts Medicare.

Medicare Savings Accounts (MSAs) are a type of Medicare Advantage plan that allows you to save money for future medical expenses. MSAs are paired with a high-deductible health plan (HDHP). You can use the money in your MSA to pay for medical expenses, including deductibles, copays, and coinsurance.

| Feature | Original Medicare | Medicare Advantage PPO | Medicare Supplement | Medicare Savings Account (MSA) |

|---|---|---|---|---|

| Type of plan | Fee-for-service | Managed care | Private insurance | Managed care |

| Network of providers | None | Limited | None | Limited |

| Premiums | Part A: Free (for most people)Part B: Varies | Varies | Varies | Varies |

| Deductibles | Part A: $1,600Part B: $233 | Varies | Varies | High-deductible health plan (HDHP) |

| Copays | Varies | Varies | Varies | Varies |

| Coinsurance | Varies | Varies | Varies | Varies |

| Out-of-pocket maximum | Part A: $7,550Part B: $20,300 | Varies | Varies | Varies |

| Coverage | Hospital stays, doctor visits, prescription drugs, preventive care | Varies | Hospital stays, doctor visits, prescription drugs, preventive care | Varies |

FAQ Section: Mrs Ramos Is Considering A Medicare Advantage Ppo

What are the key benefits of Medicare Advantage PPOs?

Medicare Advantage PPOs offer several benefits, including comprehensive coverage, flexibility in provider choice, and potential cost savings.

What are the eligibility requirements for Medicare Advantage PPOs?

To be eligible for a Medicare Advantage PPO, individuals must be enrolled in Medicare Part A and Part B, reside in the plan’s service area, and not have End-Stage Renal Disease (ESRD).

How do I find and evaluate providers within a Medicare Advantage PPO network?

Medicare Advantage PPO plans typically provide directories of participating providers. Individuals can also use online tools to search for providers based on specialty, location, and other criteria.